Various areas of corporate finance such as structuring and fundraising, in private debt and equity and establishing traditional and innovative credit solutions.

The firm supports and advises clients in Israel and abroad including local investment entities, foreign financial product providers, family offices, investment consultants and marketers regarding their Israeli activities.

The firm specializes in setting up hedge funds and investment funds, such as debt funds, real estate funds, P2P funds (crowdfunding loans), and family wealth funds.

The firm supports, represents and advises Israel’s leading investment houses, insurers, sectorial investment entities, endowments, investment funds, investment banking companies, and other asset managers in their routine investment activities.

Various areas of corporate finance such as structuring and fundraising, in private debt and equity and establishing traditional and innovative credit solutions.

The firm supports and advises clients in Israel and abroad including local investment entities, foreign financial product providers, family offices

Various areas of corporate finance such as structuring and fundraising, in private debt and equity and establishing traditional and innovative credit solutions.

The firm supports and advises clients in Israel and abroad including local investment entities, foreign financial product providers, family offices

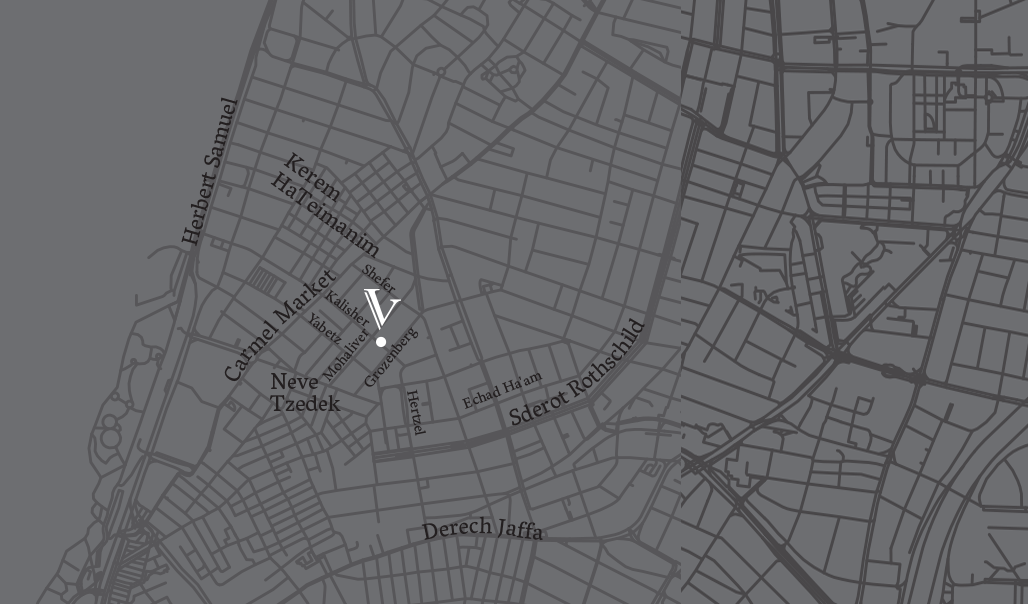

Vinograd & Co. is a boutique law firm that focuses on four core practice areas: capital markets, finance, investments and regulation. The firm specializes in the regulations in the fields of financial markets, securities and institutional entities’ investments, alongside advising on vast investment activity and the establishment of investment funds.

The Firm’s attorneys have extensive experience in providing ongoing counsel to numerous investment entities, including Israel’s leading investment houses, insurers, sectoral investment entities, endowments, investment funds, investment banking companies, family offices and other asset managers. Their in-depth knowledge and strong relationships with the relevant regulatory authorities. enable Vinograd & Co. to deliver comprehensive solutions for the challenges that arise from the regulation of institutional entities’ investments.

The legal team advises on various types of transactions, such as project and infrastructure financing, investments in credit and tailor made loans, bonds and equity investments (both public and private), mezzanine financing, ,investing in investment funds, real estate finance transactions, as well as M&A’s and debt settlements.

Our Expertise Is Your Value

Vinograd & Co. offers highly specialized practices in the fields of finance and investment funds. The firm provides counsel to Israeli and foreign hedge funds on their establishment and ongoing operations, in addition to advising on the establishment and operations of private investment funds. Furthermore, the firm also provides ongoing legal counsel to foreign financial companies which handle asset management, investment advisory and brokerage, regarding their activities in Israel.

The firm’s expertise in the fields of regulation, investment activities and institutional entities, as well as its involvement in the regulation of the market and the formation of regulatory processes, has resulted in the highest praise of the firm by both market players and regulators. In addition, through their practical experience and industry knowledge, the firm has developed niche market expertise that in turn, provides value for our clients.

Vinograd & Co. is dedicated to remaining abreast of industry changes in an ever-evolving regulatory landscape, which strengthens our ability to provide creative and trusted legal services while understanding the business and economic demands of the scenes in which our clients operate. Our expertise, together with our professional and holistic approach, ensure that we are able to provide the highest level of counsel, tailored to meet the needs of any client in our fields of expertise.

Vinograd & Co. is ranked in Tier 1, in Investment Funds and Venture Capital Funds in the prestigious The Legal 500 (Legalease)

xThe firm supports, represents and advises Israel’s leading investment houses, insurers, sectorial investment entities, endowments, investment funds, investment banking companies, and other asset managers in their routine investment activities. Fields of investment include project and infrastructure financing, investments in credit and tailor made loans, bonds and equity investments (both public and private), mezzanine financing, fund investments, real estate finance transactions, as well as M&A’s and debt settlements.

We also provide unique expertise on regulatory issues that influence decision making in the industry.

xThe firm specializes in setting up hedge funds and investment funds, such as debt funds, real estate funds, P2P funds (crowdfunding loans), and family wealth funds. By combining innovative ideas and creative thinking in building investment instruments in alternative assets, the firm and its founder have set up leading and first-of-their-kind investment funds in Israel, such as Israel’s first hedge fund-of-funds, a P2P fund (consumer credit), an insurance linked securities fund, non-traded US-RIET’s fund, real estate notes fund and more.

xThe firm supports and advises clients in Israel and abroad including local investment entities, foreign financial product providers, family offices, investment consultants and marketers regarding their Israeli activities.

xVarious areas of corporate finance such as structuring and fundraising, in private debt and equity and establishing traditional and innovative credit solutions.

x